Purchasevalacyclovir.com Review:

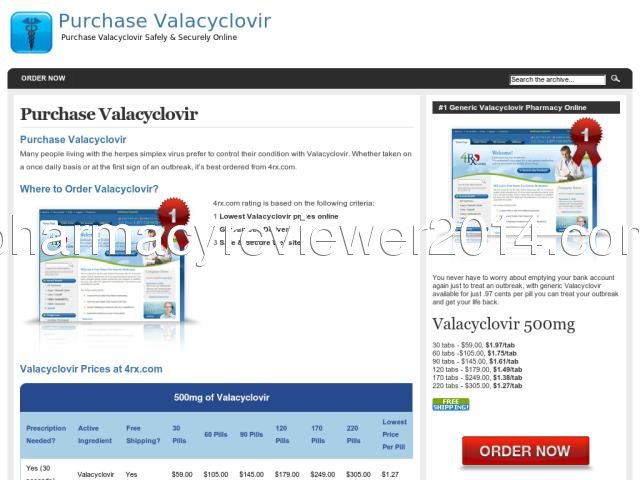

Purchase Valacyclovir | Purchase Valacyclovir Safely & Securely Online | Purchase Valacyclovir Online - Valacyclovir is the generic name of the drug better known by the trade names given it by drug manufacturer GlaxoSmithKline: Valtrex and Zelitrex. Valacyclovir as a generic is tried and tested as an effective antiviral agent.

Country: North America, US, United States

City: 95405 Santa Rosa, California

- Blue Rose "Blue Rose" - The king of accounting softwareQuickBooks pretty much rules the roost for accounting software, and with good reason. This software is intuitive and easy to set up and use. If you are unsure, the set up guides you every step of the way. You can also import your previous data from previous versions of quickbooks. The software is pretty much the standard for small business accounting software. I have used another accounting software for a few years due to better pricing, but I'm happy to come back to this one, which I think is the best. Recommended.

- Sunshine City Customer - Miami, FLSince I my first period I was never regular. At 21 my gyn put on me the pill to regulate it. I took the pill for 9 years. On november 2010 I had a laparoscopy due to a cyst found in my left ovary. After the surgery and with no pills at all my cycles were more irregular than ever. Between one cycle and other were 56 days. The gyn recommended me Provera a "jump to start after the pill" but after so many bad reviews DH and I decided not to take it and instead tried Fertilaid which has amazing reviews. Three days after taking it I had my first period. After the first bottle I decided to take a second bottle to maintain my cycle in 33 days (Fertilaid decreased from 56 to 33 days!). When I started taking the second bottle 5 days before AF I had my BFP!! I am 5 weeks pregnant now. We tried to conceived for 3 months before Fertilaid and after Fertilaid it took us only month and a half. I totally recommended this product.

- E. B. Kramer - Best Makeup on the MarketI've been using the Bare Escentuals line for over 2 years now and love it. After years of getting thick foundation that would settle in lines, make me breakout or melt off by midday, bareMinerals is the one I chose. Covers everything you want to cover and is light as air. You don't know your wearing makeup! SPF protection, a wide array of colors all helpful and was the main concern for me, I'm half Asian half Caucasian, I never could find the right shade until now. If you don't find the exact shade which is virtually impossible, buy 2 shades and mix until it's right for you. It make you look naturally flawless not "made up".

- Katie - Because sometimes a limerick says it bestThis week's town hall got most intense

When this query caused strife immense:

"How long must we holler

That men earn a dollar

And women just seventy cents?"

Barack was on point, but poor Mitt

Just came off as sorely unfit.

Those women in binders

Will serve as reminders

He doesn't get "equal" one whit. - Aaron C. Brown - The best got betterI have to begin with a gripe. The first four reviews are implausibly quick, given the length of this book, and are all five-star. Three are from people who reviewed only one product, one is completely devioid of content. The fifth reviewer has reviewed one other product, a razor. I understand the temptation to stuff the ballot-box early by having friends review, but I think you should find real reviewers and insist on some content.

There are several great valuation books out there. Damodaran on Valuation concentrates on security valuation and is the most academic. Business Valuation is the best for small, private companies. Business Valuation on Wall Street tells you how Wall Street approaches the question. Theory of Valuation is the best on theory. Corporate Finance has the best treatment of valuation among corporate finance texts.

Earlier editions of this book were the clear leaders in big and complex public company valuation. There is extensive and detailed instruction for a big team analyzing for a big project, whether it is capital budgeting, capital structure, merger, acquisition, restructuring, bankruptcy or any other valuation topic. It is comprehensive and clear. If you work on this kind of project, you need this book. If you don't work on this kind of project, it can still give you a tremendous amount of insight into the factors that contribute to shareholder value.

The most important improvement in the fifth edition is to go beyond the developed-markets/US-style financial statement presentation to cover emerging market companies in detail. I can't say whether the section is good as I have zero experience in that area, but it sounds right and I trust the authors. The treatment of capital structure and investor relations is considerably improved based on events of the last three years. They also stuck in some useless fluff about the necessity to maximize shareholder value and behavioral finance (I don't mean those aren't interesting areas, just that there's no depth to the presentation in this book, and clearly no real interest by the authors).

One minor gripe is the examples are usually placed around the beginning of 2008, for a book published in 2010. That's a big difference considering what happened in 2008 and 2009. I understand why you don't want to rework every example of a book this big, but some of the projections are downright comical to someone knowing what actually happened. I suppose that might help readers develop humility, at the end of the day, valuation is a matter of opinion based on highly uncertain information about totally unknowable future events. The weight and slick production values of tihs book might cause some to forget that.